A few weeks ago, Binance Coin (BNB) hit a new all-time-high of $25.54, making it the first coin to do so since the bull market of 2017. This article describes Binance Coin and why it's uniquely valuable.

Overview

- What is Binance?

- What is Binance Coin?

- But Why is BNB Valuable?

- Incentives for Binance Users

- Reduced Trading Fees

- Affiliate Rewards

- Launchpad Lottery

- Potential Future Rewards

- A Stake in Binance Chain

- The Evolution of BNB

- Binance Chain vs. Ethereum

- Decentralization vs. Performance

- Broad Features vs. Key Features

- Binance Chain Applications

- Hosting Coins

- Decentralized Exchange (aka DEX)

- Store of Value

- Increasing Utility (Demand)

- BNB Coin Burns (Supply)

- Market Cap

- Various Market Caps

- Price Over Time

- Incentives for Binance Users

- Risks

- Is BNB a Security?

- Is Binance Chain Decentralized?

- Closing Thoughts

First—What is Binance?

In short, Binance is a popular and well-trusted crypto exchange.

It launched in July 2017, and within a year had 10 million users. Unlike many of its competitors, Binance didn't initially offer fiat-to-crypto markets (for example, USD-to-Bitcoin). Instead, it offered a variety of crypto-to-crypto markets (for example, Bitcoin-to-BAT). This attracted users who couldn't get these coins on other exchanges.

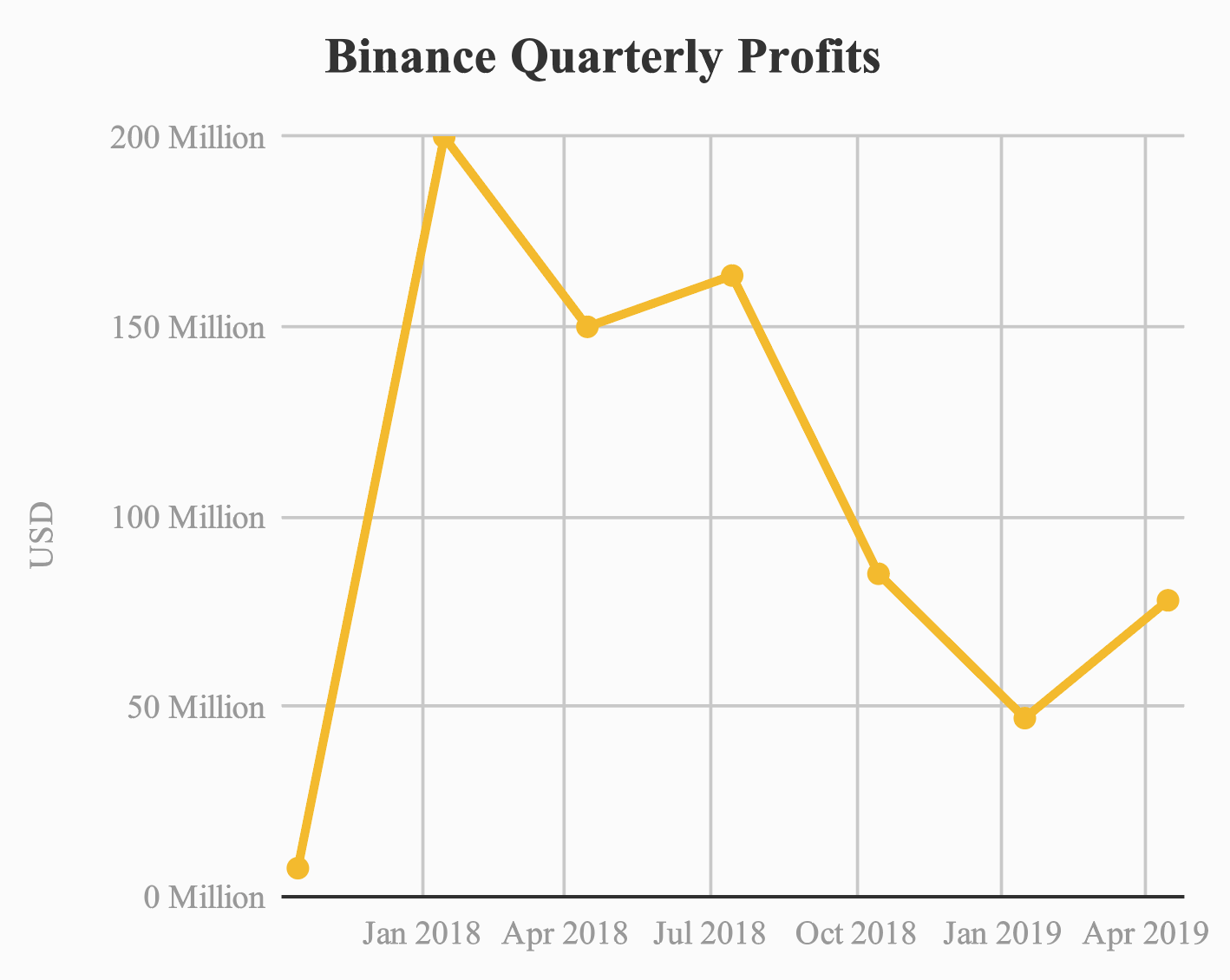

This, combined with Binance's low trading fees, high trust, and stable technology, led to quick growth. Throughout its short history, Binance has been spectacularly profitable, raking in $446 Million profit in 2018 alone.

Not a Normal Company

To understand Binance Coin (BNB), it's first important to understand that Binance is not a normal business. Why? Because a normal business wants to:

- Increase the value of the company.

But Binance is different. Because they not only run a company, but also run a currency. Because of this, Binance's goals probably look like:

- Increase the value of Binance (the company).

- Increase the value of BNB (the currency).

It's important to emphasize this is a company-wide goal. According to Michael Arrington (founder of TechCrunch), 90% of Binance employees receive a portion of their salary in BNB.

So What is Binance Coin?

As a quick (but insufficient) overview, Binance created a currency and called it BNB.

Some top-level details on BNB:

- Binance created BNB in July 2017 to fund their launch.

- Exactly 200 million BNB were created—this amount can never increase.

- Here's how Binance split this up:

- 100 Million BNB. For their 3-week Initial Coin Offering (ICO) in July 2017—early supporters sent Bitcoin or Ethereum to Binance in exchange for BNB (at about $0.15/BNB).

- 80 Million BNB. For Binance's team—with the total amount being distributed over the course of 5 years (16 million BNB per year until July 2021).

- 20 Million BNB. For Binance's angel investors.

- While the 200 million BNB supply can never increase, it can (and will) decrease.

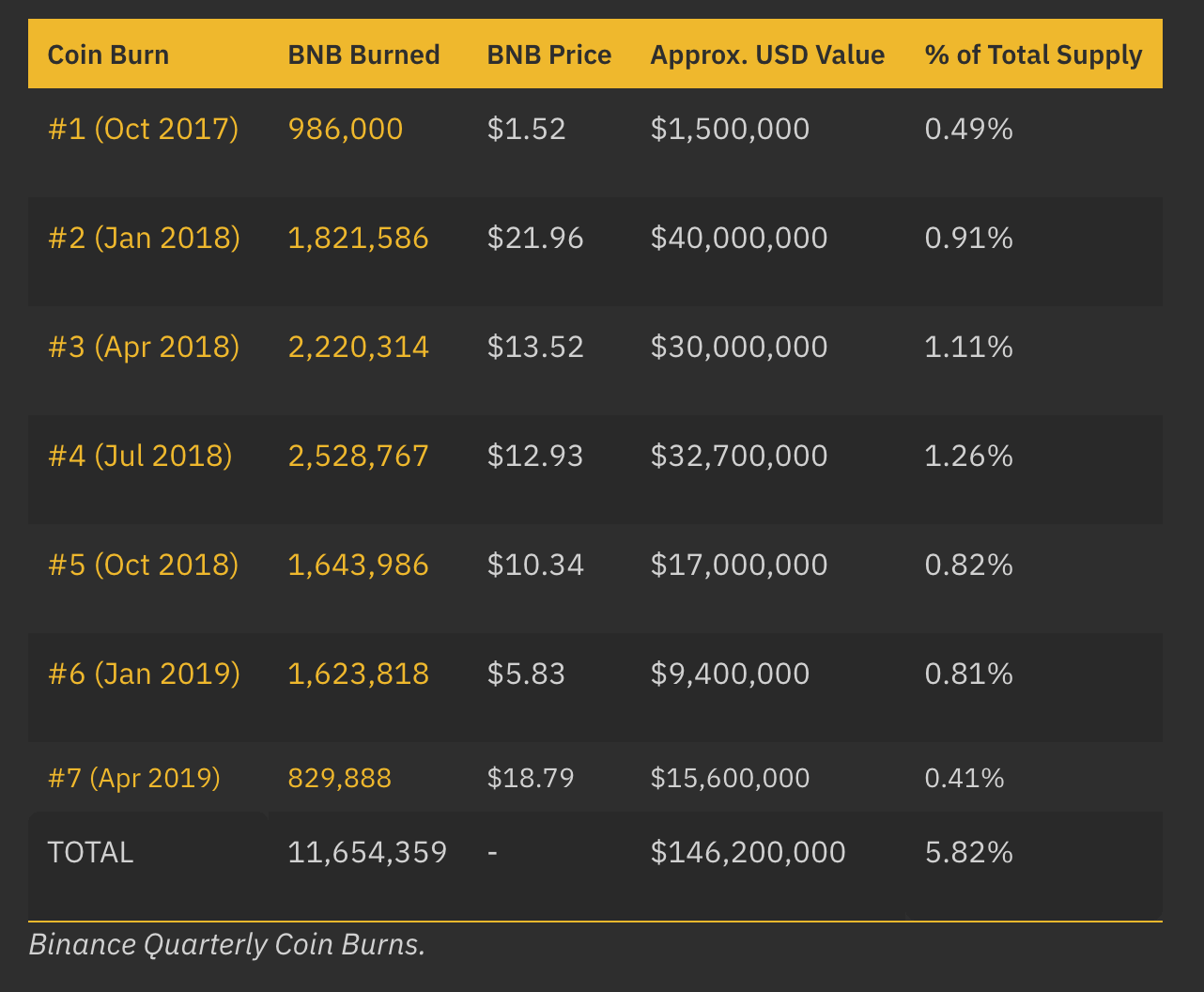

- How? Each quarter, Binance uses 20% of its profits to permanently destroy an equivalent amount of BNB (through a built-in "self-destruct" feature of BNB).

- This is similar to a dividend, but instead of paying people in fiat (how a dividend works), Binance reduces the total supply of BNB by the same value.

- While theoretically giving BNB holders the same value as a dividend, it's an interesting marketing technique because the value is distributed directly into BNB instead of a fiat currency.

- To date, there have been 7 coin burns, which have reduced the initial 200 million BNB supply by 5.8% (or 11.7 million BNB). Below is a summary of these coin burns.

- Binance will continue burning BNB every quarter until the total supply is 100 million (half the original supply).

But Still, Why Would Anyone Hold BNB?

"Okay okay...just because there's only 200 Million BNB doesn't make it valuable. Isn't this some BS internet scam from a cash-hungry company trying to turn their fake money into real money?"

First part, yes, second part, no. Scarcity alone doesn't give BNB value—instead, its value comes from the unique benefits of holding it.

Holding BNB provides 3 key benefits, which I'll describe through the rest of the article:

- Incentives for Binance Users

- A Stake in Binance Chain (Binance's New Blockchain Technology)

- A Store of Value

Incentives for Binance Users

Like any currency, the value of BNB rises as more people hold it (and falls as more people exchange it for other currencies). Because of this, Binance offers incentives to those who own BNB:

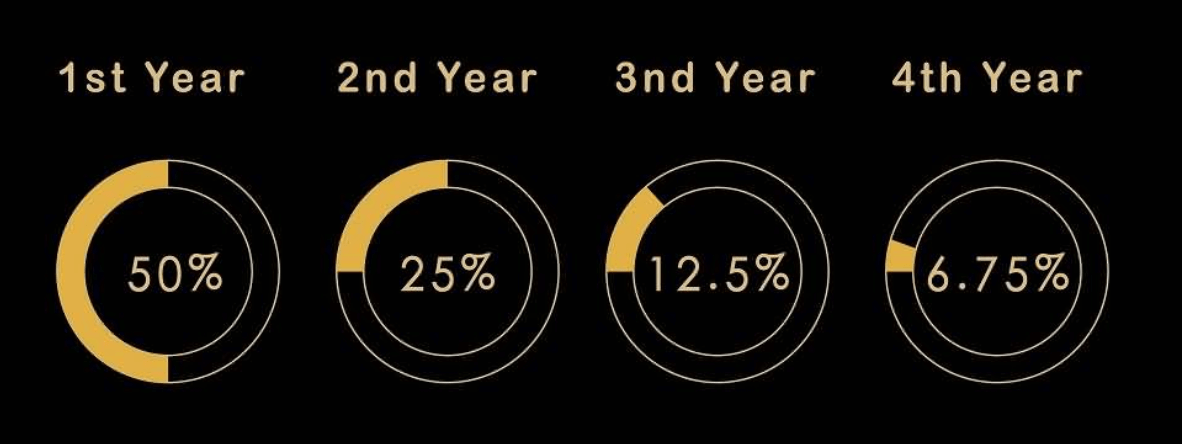

Reduced Trading Fees. If Binance users opt to pay exchange fees in BNB, they receive a discount (starting at 50%, and getting halved each year until expiring in July 2021).

Affiliate Rewards. Users who hold 500 BNB or more get twice the commission on Binance's referral program (40% vs. the normal 20%).

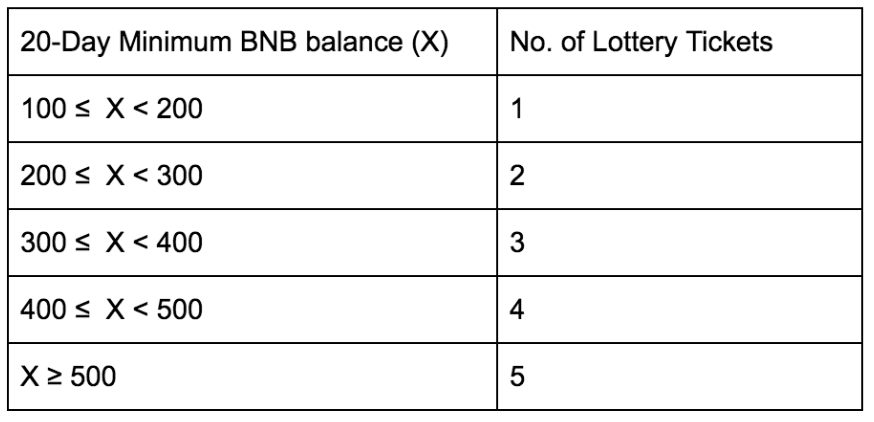

Launchpad Lottery. Binance's "Launchpad" lets users invest in new crypto projects that have been vetted by Binance (sort of like Kickstarter-for-crypto, but with a more rigorous selection process). Previously, Binance let users invest in projects on a first-come-first-serve basis, but they recently updated this to a lottery system exclusive to BNB holders, with the largest holders getting the most lottery tickets.

Potential for Future Rewards. Since BNB's launch, Binance has continually added new benefits to the coin (i.e. affiliate rate increase in May '18, Launchpad update in March '19). Given their past record, it seems likely Binance will continue adding incentives to BNB. And since nobody knows the future price of BNB, users may be compelled to accumulate the coin early.

A Stake in Binance Chain (Binance's New Blockchain Technology)

While BNB started as a rewards system for Binance users, it's now morphing to power a new (and much needed) blockchain technology from Binance. To understand the unique value of Binance Chain, it's first necessary to understand the evolution of BNB.

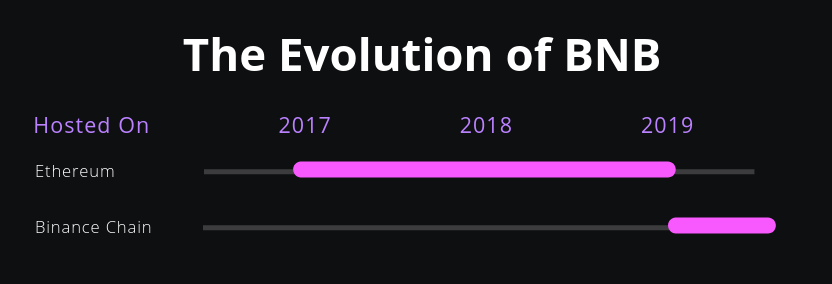

- 2017 – 2019: BNB hosted on Ethereum

- While people describe "blockchain" in many ways, one of its key innovations was creating true scarcity online. It's how Binance can mint only 200 Million BNB. Unlike a catchy MP3 file, someone can't just duplicate their BNB and email it to a friend. If I send BNB to a friend, then I'll no longer have it.

- Even though this technology is valuable, it's also complex to build. To avoid re-engineering the whole thing, Binance launched BNB on the Ethereum platform in 2017. Without diving into too much detail, Ethereum made it easier for blockchain projects to launch (kinda like how Wordpress makes it easier for websites to launch without knowing HTML).

- 2019 & on: BNB hosted on Binance Chain

- Despite the benefits of Ethereum, Binance also saw drawbacks.

- Because of this, Binance launched its own blockchain platform—Binance Chain—in April 2019 (at the same time, migrating BNB from Ethereum to Binance Chain).

- While similar to Ethereum in some ways, Binance Chain introduces a much-needed performance upgrade to the crypto ecosystem that previously did not exist.

Binance Chain vs. Ethereum

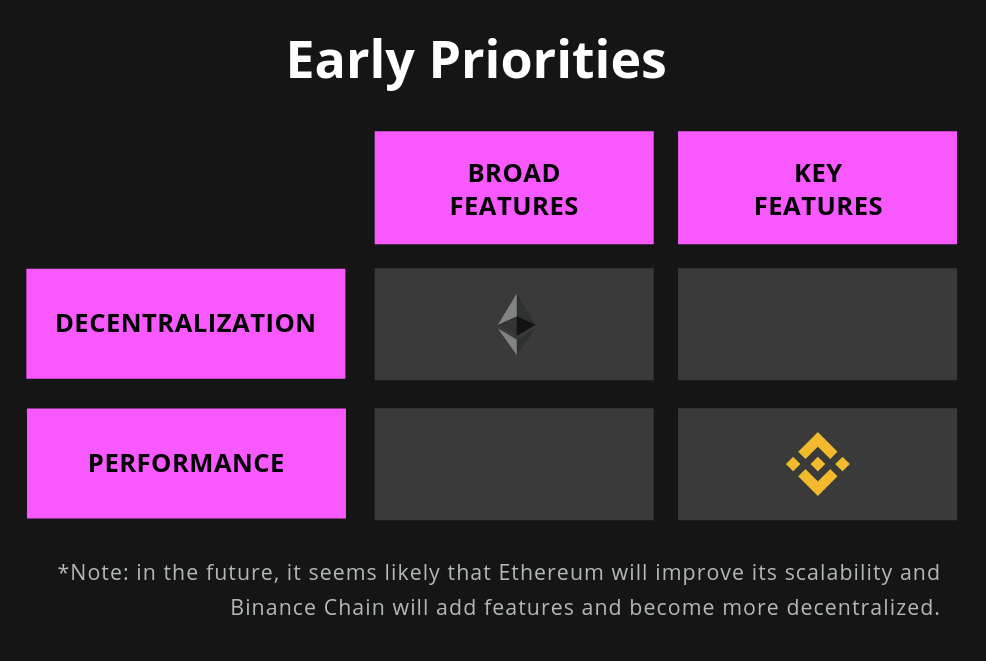

Despite the similarities of Binance Chain and Ethereum, the primary difference is what each blockchain values. The key trade-offs are (1) Decentralization vs. Performance and (2) Broad Features vs. Key Features.

Decentralization vs. Performance

- Ethereum values Decentralization.

- Because Ethereum runs on thousands of computers throughout the world (which are paid in ETH for contributing to the network), it has been called "The World Computer."

- Why? Because even when one of these computers goes offline, Ethereum continues to run on the rest of the network. This makes it nearly impossible for a program on Ethereum to go offline.

- While valuable, this decentralization comes at a cost. At the moment, Ethereum can only process 15 transactions per second (to be fair, Ethereum does hope to scale this).

- Binance Chain values Performance.

- Unlike the thousands of computers that run Ethereum, Binance Chain will launch with only 11 large-scale computers (though similarly to ETH, they are paid in BNB for contributing).

- While initially less decentralized, Binance Chain compensates for this in speed and reliability. According to CEO Changpeng "CZ" Zhao, Binance Chain will process "a couple of thousands" transactions per second at launch.

- This upgrade is huge for the cryptocurrency ecosystem, and could enable applications that were previously impossible.

Broad Features vs. Key Features

- Ethereum values Broad Features.

- As mentioned, Ethereum makes it easy for blockchain projects to launch (such as BNB before it migrated Binance Chain).

- Along with this feature, Ethereum also allows projects to run Turing-complete programs (which, in layman's terms, is a program that can theoretically do anything).

- Binance Chain values Key Features.

- Unlike Ethereum, Binance Chain is not designed to run any program.

- Instead, it has 2 main features: hosting scarce assets and exchanging scarce assets for one another.

- According to CZ (Binance's CEO), "Binance Chain is a very simple chain in terms of application, but it can handle very large loads. It is our opinion that the load is more important than the features."

- Even so, it is likely Binance will add features in the future. According to their website, "Once we show that the infrastructure is sound enough to handle many transactions quickly, the additional features will follow."

Binance Chain Applications

While Binance Chain may expand to more applications in the future, its initial 2 use cases are (1) hosting coins and (2) a decentralized exchange.

Hosting Coins

- Similar to how Binance used Ethereum to launched BNB in 2017, other blockchain projects can now use Binance Chain to launch their own coins.

- While Binance Chain's feature set is more limited than Ethereum, there are still use cases.

- For example:

- Let's say a subscription-based company launches a coin (we'll call it SUB).

- Instead of charging monthly for their service, they choose a "HOLD" model—everyone who holds 1,000 SUB or more can access the service.

- Early users get the cheapest price, feel special, and wind up telling their friends about it—plus, this recommendation would be time-sensitive, because every second you don't tell your friend, the price might rise.

- Is this actually a good business idea? Who knows. Just an example to show the power of Binance Chain.

- For example:

- At the time of writing, several projects have already migrated their coins from Ethereum to Binance Chain, including:

- Mithril (a decentralized social media platform).

- Atomic Wallet (a cryptocurrency wallet).

- CanYa (a decentralized freelancing platform)

Decentralized Exchange (aka DEX)

- Despite the massive success of Binance's exchange ($446 million profit in 2018), it's still centralized.

- Why does this even matter? To understand, let's compare it to Facebook vs. Email.

- Facebook is centralized. To use it, you create an account with Facebook. Facebook stores your data. When it goes offline, you can't access it.

- But email is decentralized. Anyone can run an email server. And even though most people use a centralized provider (like Gmail), their data is stored only by that provider (compared to one dystopian company storing the entire world's email).

- While Binance's current exchange is like Facebook, Binance's DEX is more like email—users don't create an account with Binance directly, but instead connect with only an address.

- As an interesting byproduct, this opens the door for centralized clients to build around Binance's DEX (like how Gmail was built around email).

- Despite the benefits of a DEX, no current provider has gained significant traction. Why?

- Current DEX's offer slower experiences, less liquidity, and less intuitive user interfaces than centralized exchanges.

- Additionally, current DEX's may struggle to obtain user trust because they don't already run a centralized exchange.

- At first, this seems like a contradiction—isn't decentralization typically associated with more trust, not less?

- Usually yes, but Binance has already gained the trust of millions of users.

- As one of these users, I'm more likely to trust a DEX from Binance than a company I've never heard of.

- Paradoxically, the best way to launch a DEX may be to already run a successful centralized exchange.

- And unlike existing DEX options, Binance's DEX will support the same speeds as its centralized exchange (since Binance Chain was designed specifically for this purpose).

- But why would Binance even want a DEX? They make tons of money through their centralized exchange's fees, yet they won't collect any exchange fees through their DEX. While some might see this as a dumb business move, the below 2 quotes from CZ (Binance's CEO) show his reasoning:

- "I adopted this philosophy that we want to disrupt ourselves and not let other people—not wait for other people—to disrupt us. So that's why we’re offering Binance.com as the centralized exchange...and then we are also offering the decentralized exchange Binance DEX. We're going to let the market decide." –CZ (February 6, 2019)

- "From an earnings standpoint, Binance DEX will not directly increase profitability for Binance, but it will certainly increase the utility of BNB in a big way. That should be good for BNB holders. Binance is also a larger holder of BNB, so we benefit the same way as all BNB holders. The more people using Binance Chain, the more value is created, or the more successful we all become." –CZ (January 15, 2019)

Store of Value

Price is a function of demand and supply. Theoretically, price rises either when demand rises or supply falls. To analyze BNB as a potential store of value, let's examine the demand and supply, along with the current market cap (note: this is not investment advice, only my perspective. Crypto is risky - never invest more than than you're willing to lose).

Increasing Utility (Demand)

Since Binance's technology typically includes incentives for BNB holders, it's hard to imagine the value of Binance rising without the value of BNB rising as well. Given Binance's progress to date (after launching less than 2 years ago), it's possibly just the beginning for them. And if so, it may be just the beginning for BNB as well.

BNB Coin Burns (Supply)

By using 20% of its profits each quarter to "burn" BNB, Binance will eventually reduce the supply of BNB from 200 million to 100 million.

There are still 3 times when the BNB supply will increase—distributions of 16 million BNB to the Binance team in July 2019, July 2020, and July 2021. Though after July 2021, the supply will exclusively decrease.

At the time of writing, the circulating supply of BNB is 140.3 million. Below shows the math on this:

200 million (initial supply) – 11.7 million (already burned) – 48 million (reserved for team) = 140.3 million

Market Cap

Market capitalization (aka market cap) measures the total value of a company or currency—it's the number of circulating shares multiplied by the price per share. As an example, let's say 1 million ImaginaryFakeCoins (IFC) exist at a price of $5 per IFC—then the market cap is $5 million.

At the time of writing, Binance Coin's market cap is $3.3 billion. Below I've included some market caps of cryptocurrencies, companies, and gold—not that these relate directly to BNB, but just to give an idea of what things can be worth. For instance, if Binance somehow achieves the scale and profitability of Facebook (an enormous feat), it's reasonable to think the market cap could surpass well over $100 billion.

Various Market Caps (as of May 15, 2019)

- Binance Coin (BNB): $3.8 billion

- Snapchat: $14 billion

- Ethereum (ETH): $28 billion

- Tesla: $41 billion

- Bitcoin (BTC): $147 billion

- Facebook: $532 billion

- Apple: $878 billion

- Gold: $8 trillion

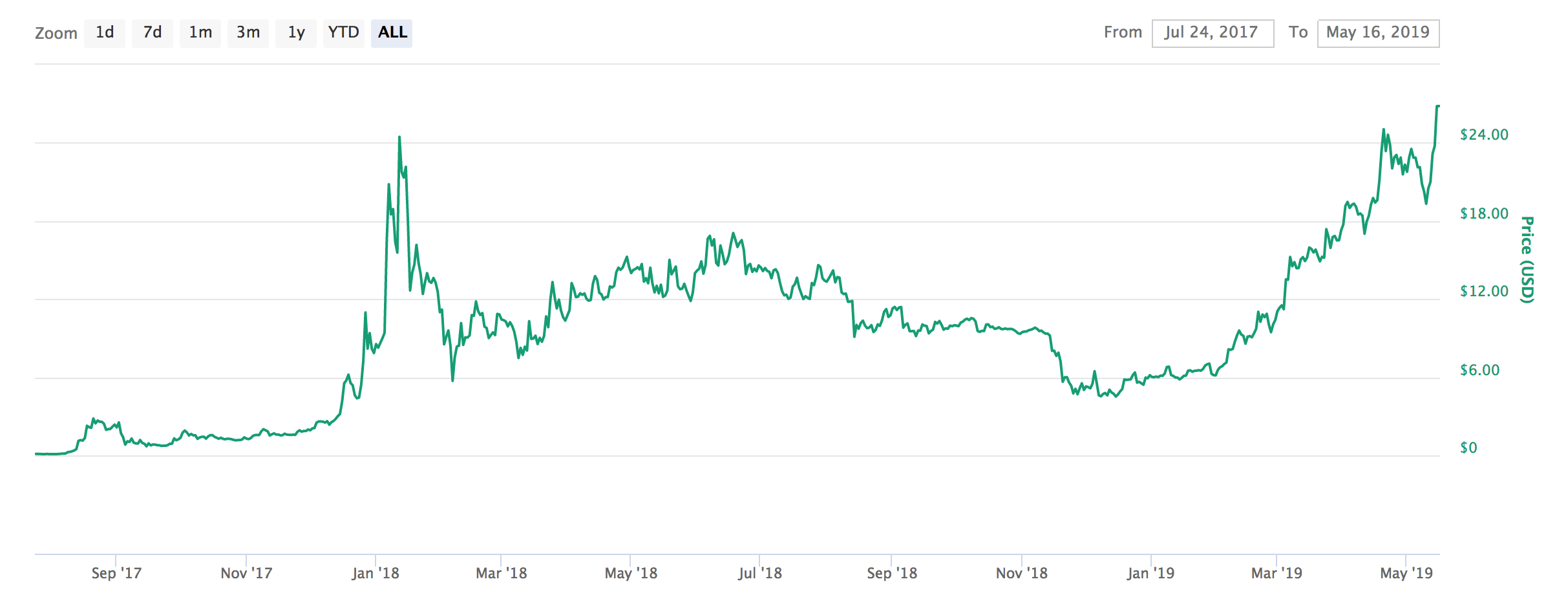

Price Over Time

- Binance Coin launched in July 2017, trading around $0.10/BNB.

- It rose in the 2017 bull market, reaching a high of $24.71 in January 2018.

- It fell in the 2018 bear market, hitting a low of $4.19 in December 2018, before recovering to new highs these past few weeks.

- Below shows BNB's price over time (via CoinMarketCap).

Risks

Is BNB a Security?

The growth of cryptocurrency has led to speculation that some coins are securities. While these laws vary from country to country, being classified as a security could lead to tighter regulation around BNB. Since most security laws were created before cryptocurrency existed, there may be some grey area here. It will be interesting to follow this over the next few years as regulations catch up with the technology.

Is Binance Chain Decentralized?

Despite Ethereum's current scaling issues, it is highly decentralized. Conversely, Binance Chain launched with only 11 validators (selected directly by Binance).

While some see this as an issue, I see it as a strength. Decentralization has the unique power to safeguard systems against the whims of a centralized, self-interested party. However, by this same definition, it's difficult for a centralized party to update and improve upon a system once it's already decentralized—and early on is when a technology should be rapidly improved upon.

Because of this, Binance Chain is pursuing performance and then increasing decentralization (in contrast to Ethereum, which did the opposite). As CZ put it, "as a new blockchain, the initial team will naturally have more influence over the strategic direction of its growth. We believe this is a good thing for a young chain and will allow faster decision making and a higher degree of efficiency."

Closing Thoughts

In a short time, Binance has achieved remarkable success. To launch in July of 2017 and profit $446 million in 2018 is just astonishing—even compared to the early days of Facebook, Uber, and Snapchat. For comparison, Snapchat launched in 2011 and didn't surpass $446 million in revenue until 2017 (and is still not profitable).

At this point, Binance is likely the most successful crypto exchange in the world. In its April 2019 report, the Blockchain Transparency Institute ranked Binance #1 in terms of trading volume—possibly the most important stat because it signals high liquidity. Why is liquidity is so key for any exchange? The below 2 quotes from Multicoin Capital's BNB Analysis explain it well:

"Exchanges are one of the few businesses that have strong network effects. Liquidity attracts more liquidity. That is why most nations only have one dominant stock exchange."

"Binance has already captured the liquidity pool for many of these longer-tail assets. Thus, exchanges that attempt to offer trading pairs for these tokens will likely find themselves late to the party, and unable to catch up to Binance’s leading market share. There are simply no real reasons for traders to leave Binance’s liquidity pool to move to a smaller liquidity pool with higher fees."

Despite all this, cryptocurrency still has a stigma. Many people see it as slimy and scammy, which makes sense given the vast amounts of slime and scam in the industry. Security firm CipherTrace estimates that, in the first quarter of 2019 alone, crypto theft, fraud, and scams topped $1.2 billion.

However, while the greedy bad actors hurt crypto's image, Binance seems to prioritize user trust above all else. Investor Su Zhu tweeted that Binance "has become the most trusted exchange among actual users"—a sentiment I agree with.

Why is Binance so trusted? Partially because it's never suffered a serious hack. Welp. Well I was gonna write that, but soon after typing it out, Binance suffered its first serious hack, with $40 million of Bitcoin stolen by hackers (the hackers also made off, metaphorically, with my previous conclusion). While this initially seems scary, Binance's risk policy worked as designed, and no customers lost money.

Here's what happened, and how Binance responded:

- At any given time, Binance keeps 2% of its funds in a hot wallet. While cold storage is more secure (only accessible in-person by Binance), a hot wallet is convenient because it allows users to withdraw funds from Binance at any time.

- Using advanced techniques, the hackers infiltrated many user accounts over time, waited patiently, and withdrew 7,000 BTC from Binance's hot wallet in a way that bypassed Binance's security.

- While unfortunate, Binance did plan ahead to safeguard against this scenario. In July 2018, they established the Secure Asset Fund for Users (SAFU), which allocated 10% of all trading fees in case of a serious hack—because of this fund, no customers lost money.

- Binance also closed deposits and withdrawals for a week to conduct a security review.

- While certainly alarming, this doesn't seriously concern me.

- Why? Because cryptocurrency is still new. Just as banks have been robbed, exchanges will be hacked. Binance realized this beforehand, only had 2% of their crypto in hot storage, and responded with a large amount of transparency.

- Soon after the hack, CZ responded to many users directly on Twitter and conducted a live AMA. As Anthony Pompliano remarked in his daily crypto newsletter, "this level of transparency is unheard of in traditional finance."

- And though unfortunate, the hack did illuminate flaws in Binance's security, which will make the exchange more secure in the future. As CZ tweeted, "while it is a very expensive lesson for us, it is nevertheless a lesson. It was our responsibility to safe guard user funds. We should own up it. We will learn and improve."

In any event, back to the closing thoughts.

Part of Binance's remarkable progress should be attributed to the transparency and values of CZ, its CEO. He made a particularly strong impression on Michael Arrington, founder of TechCrunch, who wrote a blog titled "Binance CEO Changpeng Zhao Is The Real Deal." True to title, Arrington notes midway through the article that "he's the real fucking deal."

However, the blog's most powerful quote comes just after that:

In my days at TechCrunch I had the opportunity to meet and interview many of the leading business people of our time. Steve Jobs, Eric Schmidt, Larry Page, Jeff Bezos, Bill Gates, Mark Zuckerberg and many others. I don’t know if CZ will reach the same level of success as these other people, but I do think one thing – he’s right up there in that group of titans in terms of personality, drive, charisma, etc.

It's hard to imagine a stronger endorsement. Though at the same time, I get it. The excitement over Binance is contagious. In an industry filled with uncertainty, it's refreshing to see a company that seems to "get it."

This excitement led Pete Rizzo, CoinDesk's editor-in-chief, to write a flattering-yet-aptly-titled article "The Unbelievable Brilliance of Binance." In it, he remarks:

"The market is only just beginning to understand just how visionary Binance is and what its success...says about something we all are striving to find: a model for building scalable and impactful cryptocurrency businesses."

If we accept this premise—that the market is only beginning to understand Binance's potential—then why has it been overlooked so far? I see a few reasons:

- First, Binance doesn't fit the "Silicon Valley startup" mold. It's not a US company. It didn't fundraise from prominent VC's. Even their website design differs from the sleek minimalism that's common among US tech startups.

- Second, unlike something like Uber ("get a taxi from your phone"), crypto is just harder to grasp at first. Understandably, many people still haven't fully learned about crypto (and those who do often start with Bitcoin).

- Third, much of Silicon Valley (and the world) got rich on the fiat financial system. It's inherently scary to think government-backed money could be vulnerable to technology. In many ways, it's more comforting to believe cryptocurrency will fail than to consider the political and economic implications of its success.

Regardless of whether Binance has been overlooked, I'd argue that its quick success was partially caused by BNB itself.

Why? Because BNB incentivizes anyone who can grow Binance to do so. Imagine how exciting it must be to work at Binance—knowing your team not only invented the currency you get paid in, but also aims to increase its value. Even if you compare BNB to a regular stock option, it's still more motivating because employees (1) decide precisely how much to hold and (2) have the peace of mind that their supply won't be heavily diluted over time by new shareholders (as is common with startups).

Along with motivating the team, BNB also transforms Binance users into stakeholders. Users who hold BNB are inevitably more excited to learn about Binance, root for its ecosystem, and spread the word (priceless marketing in an intimidating industry like crypto).

And unlike a regular stock, BNB provides a stake in Binance-the-ecosystem, compared to only Binance-the-company. This is an important distinction, because Binance's decentralized tech (such as their DEX) often won't generate profit for Binance-the-company, but instead will add value to BNB.

If I had to define BNB in one sentence, I'd say it's a mass incentive to grow Binance's ecosystem. True to the spirit of decentralization, it allows anyone—regardless of where they live or whether they work at Binance—to become a stakeholder in this ecosystem. Okay, that was two sentences.

Anyhow, it's promising that CZ seems to truly believe in this spirit of decentralization. Below is a quote from his blog, where he describes the cycles of power over human history, flowing back and forth between centralization and decentralization. The excerpt illuminates not only crypto's appeals to human nature, but also CZ's thoughtfulness—he's a compelling leader to follow:

A famous opening line from a Chinese novel, The Three Kingdoms, brings perspective on this matter: “Speaking of important things under heaven, anything that is united will divide, and anything that is divided will unite.”

In a decentralized world (at least in our history so far), we will experience more chaos. As social animals, we group together. It is human nature to elect and follow leaders. When our groups get bigger or are merged (or taken over) by others, we become more centralized. Usually, in the early generations of centralization, the leaders are heroes, ethical and selfless, and protect the people. Life for the people is good. Then after a few generations, the successors (either by blood or vote) to the throne or power get jaded, and lust for more money and power. Can’t blame them, that’s just human nature. They tend to be less motivated by helping the people, but rather focus more on their personal gains or benefits. As a result, people suffer, and want more decentralization. Eventually, a revolution happens, and the cycle repeats itself.

Today, our world is on the more centralized side with some governments having too much power, and they control everything from what you can say to how you can spend your money. That’s why many people demand more decentralization, and why cryptocurrency is popular.

In any event, I'm excited to keep following the progress of Binance and BNB over time.

As I mentioned earlier, this isn't investment advice. While I do own BNB, I'm not recommending whether you should own it too—only describing it from my point of view. Buying cryptocurrency is risky, and anything could happen (that said, if you do want to buy, I wrote this guide on how to buy BNB).

You made it to the end! Congrats, and I appreciate you reading. If you enjoyed it, please share with a friend! For easy sharing, the URL binancecoin.guide redirects to this page.

If you have any thoughts or questions, feel free to reach out on Twitter.

Wanna Stay Up to Date?

If so, enter your email below, and I'll let you know whenever I post a new article on CryptoGuides.